How a simple structure using a Cyprus Holding Company could offer numerous advantages

If you are planning to invest, or have already invested, in the real estate market, there may be many benefits that can be obtained by using Cyprus as part of a property ownership structure.

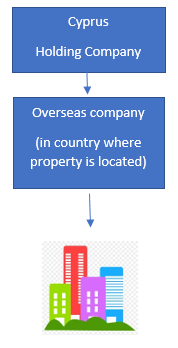

We set out below a simple example of a structure followed by a brief summary of the tax and other benefits offered by Cyprus.

Description of the structure

- The establishment of a Cyprus holding company whose shares will be held by the non-resident investor.

- The Cyprus company may receive funding in the form of debt and/or equity from its shareholder in order to invest in the share capital of the Overseas company formed in country where the immovable property is located (which will be the holder/owner of the immovable property itself.)

Summary of Cyprus tax benefits of the Cyprus Holding Company

- Income of the Cyprus holding company from dividends is tax free (subject to conditions see further below).

- Gains made by the Cyprus holding company on the sale of shares are tax free.

- Proceeds from the liquidation of subsidiaries abroad are tax free.

- Capital gains made by the Cyprus holding company on disposals of capital assets are tax free in Cyprus (except only if the capital asset is immovable property situated in Cyprus).

- Profits from activities of a Permanent Establishment abroad are tax free.

- Notional Interest Deduction on new capital introduced.

- Lower withholding tax rates in other countries on remittances of income from dividends, royalties or interest due to wider applicability of Treaties for the Avoidance of Double Taxation.

- Distributions by Cyprus Holding Companies to their non-Cyprus resident shareholders are free of tax in Cyprus. Also, distributions to Cyprus resident but non-domiciled shareholders are free of

Cyprus tax. - There are no exit taxes on the sale or during the liquidation of the Cyprus company and no withholding tax on distribution of the proceeds to the non-resident investors.

Obviously it will also be necessary to consider all the relevant tax and other regulatory requirements of the local jurisdiction where the overseas company and the property itself is situated.

Other reasons to choose Cyprus in locating your holding company

- Full membership of the EU and of the EURO Zone.

- The membership of the EU enables employment of any EU national without complicated procedures. Non EU personnel may also be employed following the required procedure for securing work-residence permits.

- No exchange controls.

- Compliance with OECD and FATF standards.

- A broad range of high-quality professional services.

- A very favorable and welcoming environment to international business.

Cyprus: General Tax Provisions

Here is some additional detailed information regarding the Corporation Tax regime in Cyprus which may also be relevant when considering using Cyprus in a property ownership structure :

Tax residency

· A company is considered to be tax resident in Cyprus if the “management and control” is exercised in Cyprus.

Notional Interest Deduction (NID)

· As of 1st January 2015, a NID is granted for new capital introduced in a Cyprus tax resident company and used in the business.

· The deemed tax deduction is equal to the amount of the new equity multiplied by a reference interest rate.

Dividends received from abroad

· As from 1st January 2016, foreign dividends received by a Cyprus tax resident company will not be exempt from corporation tax in Cyprus if these are allowed as a tax deduction in the country of residency of the dividend paying company.

· Dividends received from abroad are exempt from tax in Cyprus (SDC at the rate of 17%) if one of the following conditions is satisfied:

a) The company paying the dividend does not engage directly or indirectly more than 50% in activities which lead to passive income OR

b) The foreign tax burden on the income of the company paying the dividend is not substantially lower than the tax burden in Cyprus.

Tax credit available

· A tax credit is afforded according to the Double Taxation Agreements concluded by Cyprus. In the absence of a Double Taxation Agreement, Cyprus unilaterally affords a credit for the foreign tax paid on the same income. For dividends received from other EU Member States the underlying tax credit is also available. Furthermore, a number of Double Tax Treaties concluded by Cyprus also allow for the availance of an underlying tax credit.

Taxation of rental income in Cyprus

· Rental income is subject to both Corporation Tax (CT) and Special Defence Contribution Tax (SDC).

· The net rental income will be included in the taxable base of the Cyprus company and will be taxed at the corporate tax rate of 12,5%.

· The rate of SDC on rents is 3% and it is imposed on the gross rental income reduced by 25%.

Withholding taxes

· There are no withholding taxes on payments to non tax resident persons (companies or individuals) in respect of dividends, interest and royalties. (Royalties sourced in Cyprus have a 10% withholding tax subject to DTT provisions)

Capital Gains Tax (CGT)

· Capital gains in Cyprus are not included in the pool of ordinary trading profits of a business but instead are taxed separately under the Capital Gains Tax Law (CGT).

· Capital gains tax is only imposed on the disposal of immovable property situated in Cyprus as well as the disposal/redemption of shares in companies (other than quoted shares) in which the underlying asset (either directly or indirectly) is immovable property situated in Cyprus. Capital gains tax is imposed on the profit at a flat rate of twenty percent (20%) after allowing for indexation.

· Capital Gains that arise from the disposal of immovable property held outside Cyprus or shares in companies which may have as an underlying asset immovable property situated outside Cyprus, are completely exempt from capital gains tax.

Inheritance or Estate Taxes

· There are no inheritance or estate taxes

Wealth Taxes

· Cyprus imposes no tax on wealth.

How we can help you

Our team of experienced and qualified professionals can provide a wide range of services in relation to the Acquisition of Property in Cyprus and any other related Services.

For more information on how we may be able to assist you and your business please contact us at cosmoserve.com.cy or call (00357) 22379210.

We look forward to hearing from you.

The contents of this article should be considered to be of a general nature only not referring to any particular business. Before proceeding with any action, please request further advice relating specifically to your business. We will be very pleased to be of assistance.